how to set up a payment plan for california state taxes

Pay a 34 set-up fee that the FTB adds to the balance due. Keep enough money in.

State Of California Income Tax Rates Youtube

Call our Collections Department at 8043678045 during regular business hours to speak with a representative.

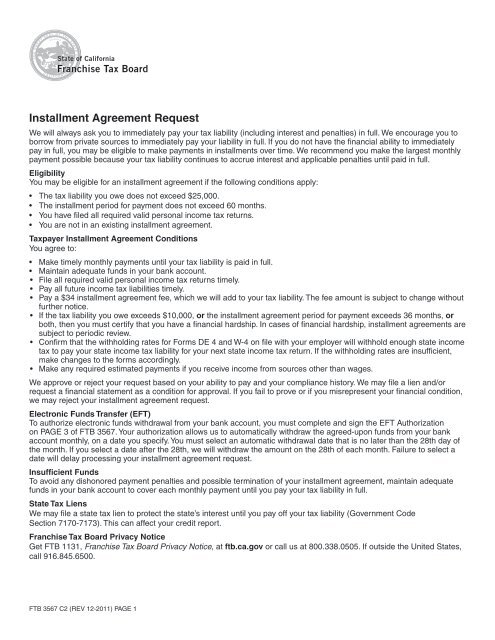

. Typically taxpayers are given three to five years by the state to pay off a balance once a California tax payment plan has been granted. Pay a 34 setup fee that will be added to my balance due. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

You may mail your completed application and payment to the address below. You can also review and manage your payment plan online. The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted.

As an individual youll. Post Office Box 512102. If you are looking to set up a payment plan that is less than 12 months in length and you owe less than 50000 you have a few options.

Your payment options depend on your total tax liability. Follow your states procedure to make payment arrangements or set up a payment plan. Pay by automatic withdrawal from my bank account.

If both the return and. Individual taxpayers need to pay a. Some states require you to complete and submit a form.

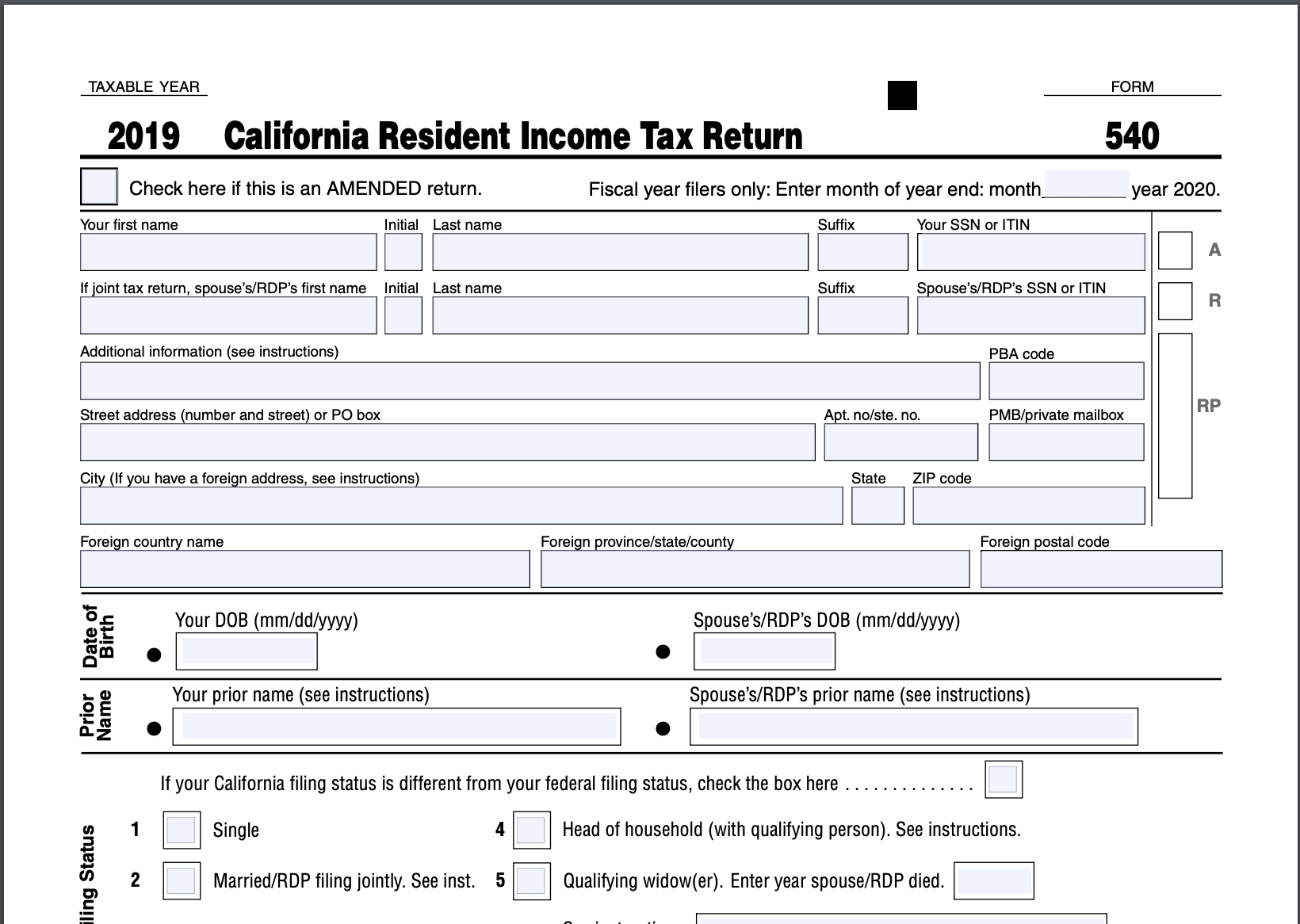

Sign in to the Community or Sign in to TurboTax and start working on your taxes. To do so you will need to file Form 9465 Installment Agreement Request and Form 433-F Collection Information Statement. County of Los Angeles Treasurer and Tax Collector.

For the state of Illinois you. It may take up to 60 days to process your request. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB.

Make monthly payments until my tax bill is paid in full. Processing the application takes 90 days and costs 34 for individuals and 50 for businesses. The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement.

Why sign in to the Community. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Timber yield tax accounts accrue a 100 penalty for failing to file a timely return or a 10 percent penalty for failing to pay the tax by the due date.

Free Payment Plan Agreement Template Word Pdf Eforms

Advice About Setting Up A Payment Plan With The State Of California

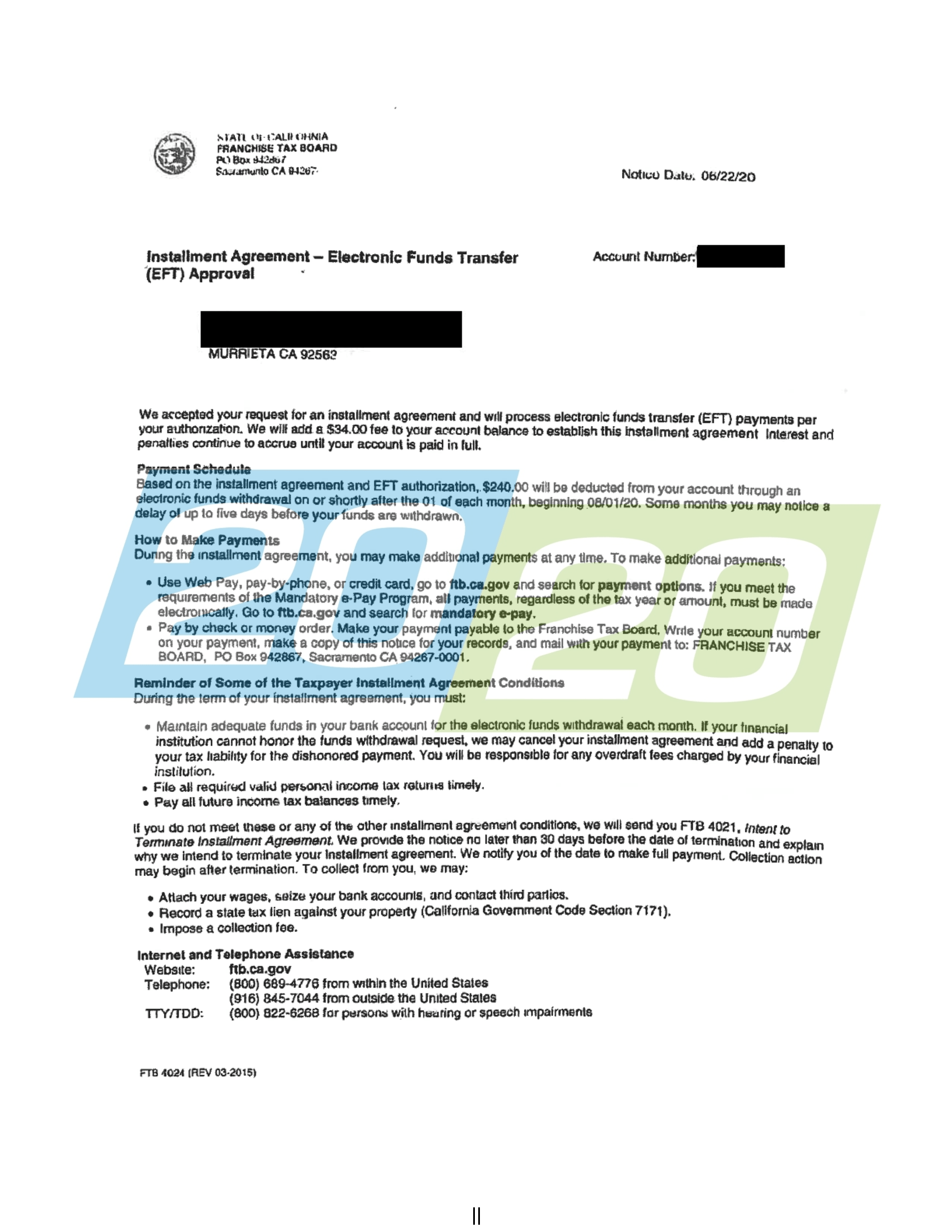

State Accepts Payment Plan In Murrieta Ca 20 20 Tax Resolution

California Inflation Relief Payments Start Arriving Today Everything You Need To Know Cnet

California 2022 Income Tax Deadline Extended To April 19 Due To Technical Glitch

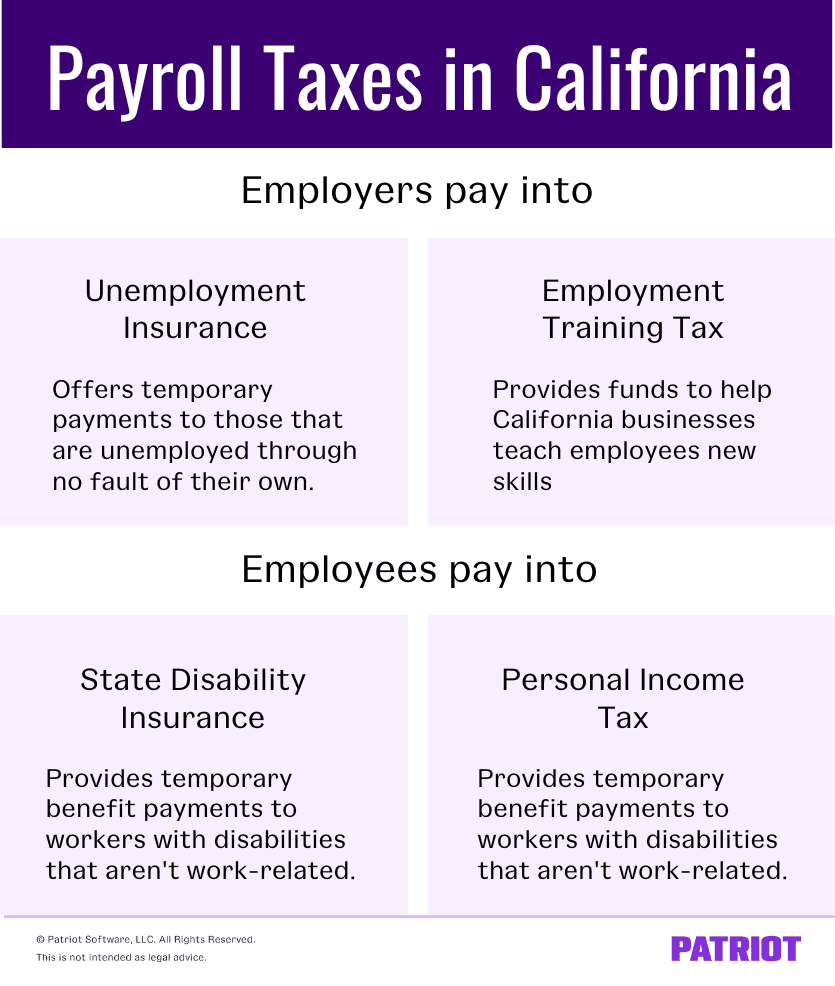

Understanding California Payroll Tax

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

New California Alaska Airlines Mileage Plan Members Get A Free Flight Up To 25 000 Loyaltylobby

Installment Agreement Request California Franchise Tax Board

Ftb Publication 1032 California Franchise Tax Board State Of

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

Ca Ftb Tax Payment Plans Or Installment Agreements

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

State Accepts Payment Plan In Santa Cruz Ca 20 20 Tax Resolution

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Important Information Regarding California State Tax Withholding

California Pursuing Income Tax From Out Of State Sellers Using Third Party Platforms Forvis

Where Do I Mail My California Tax Return Lovetoknow

California Tax Payment Plan Victory Tax Lawyers U Victorytaxlawyers

Comments

Post a Comment